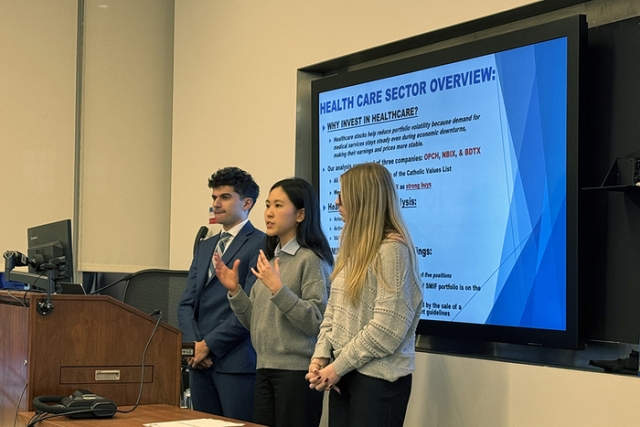

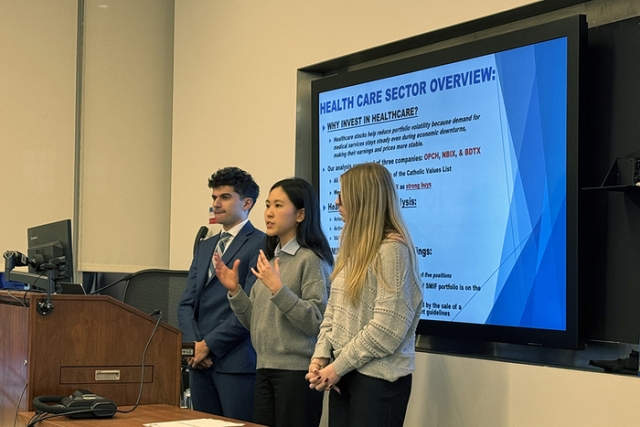

Students in The Peter J. Tobin College of Business at St. John’s University put their investment knowledge on display on December 10, delivering their recommendations for a trio of student-managed endowment funds.

Teams of students relied on a semester’s worth of study and research to offer investment recommendations for the undergraduate and graduate Student-Managed Investment Funds (SMIFs), as well as the three-year-old Student-Managed Blockchain Fund (SMBF). Both funds are part of the University’s endowment fund, which supports student scholarships, financial aid, and more.

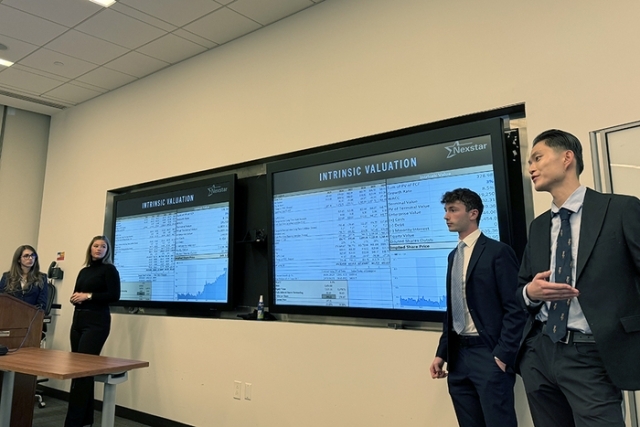

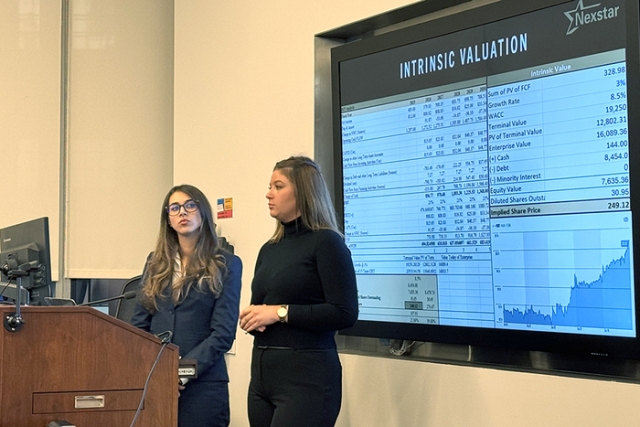

The pitches took place at the University’s Manhattan, NY, campus before a committee of faculty, administrators, and alumni, who reviewed the presentations and voted on whether to advance the transactions. All presentations included comprehensive, student-created reports on the stocks or cryptocurrencies.

“This is a great program—an opportunity to contribute to our endowment fund while gaining real-world experience,” said Andrew Gibowski, a senior finance major whose team recommended a stake in the technology titan Oracle. “We apply what we have learned through our classes at St. John’s in valuing equities while being able to give back to our school.”

More than 500 colleges and universities across the country sponsor student-managed investment funds. With combined assets of more than $13 million, St. John’s is the 15th most lucrative student-managed fund in the nation, according to The Center for Investment Research.

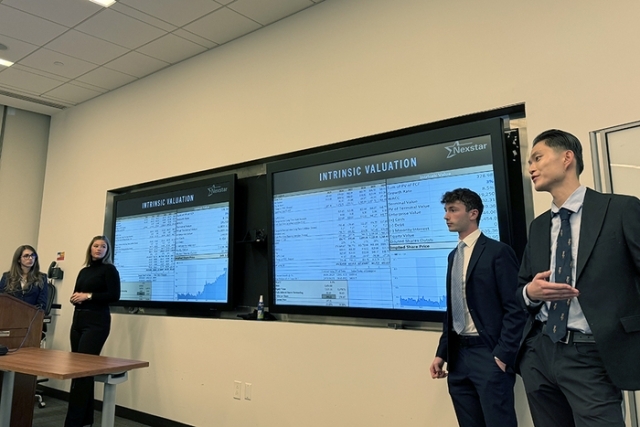

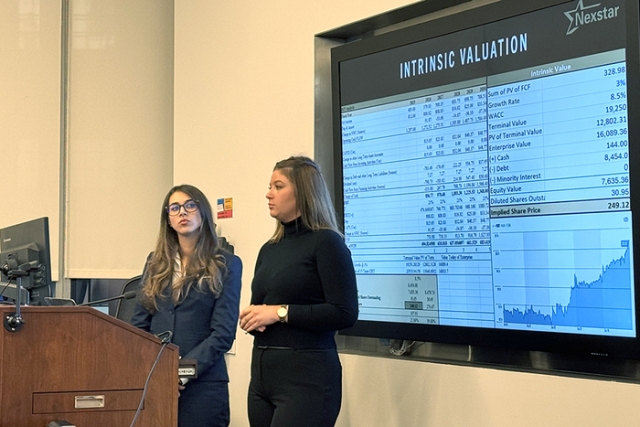

“This is the most valuable class I have taken at Tobin,” said Ava Weege, a senior finance major whose team recommended an increased position in the telecommunications giant Nexstar Media Group, Inc. “It is just such a hands-on experience. I have learned so much doing the work, and to be able to do something to help our fellow students—that is what St. John’s is about.”

The end-of-semester presentations were the climax for students enrolled in the undergraduate courses Crypto Trading and Trading Strategies and Managing Investment Funds that are offered as part of the Bachelor of Science in Finance degree program; as well as the graduate course Quantitative Asset Management, part of the Master of Science in Finance and Master of Business Administration programs.

Started in 2001, the undergraduate SMIF was valued at $8.2 million as of November 30, while the graduate fund—launched a year later—was valued at $4.9 million. Both funds, tied to long-term stock investments, have generated 9.1 percent to 10.1 percent annualized returns since inception, in line with the historic performance of the Standard & Poor’s 500.

Approved in May 2022 with an initial investment of $100,000, the SMBF complements the undergraduate SMIF. Students research cryptocurrencies and present investment recommendations for approval; the market value of the SMBF has more than doubled since its inception and stands currently at $220,381.

The student-managed stock and blockchain funds are among several experiential-learning opportunities available to St. John’s students. The Executive-in-Residence Program enables students to engage in business consulting with actual corporate and nonprofit organizations. The Global Loan Opportunities for Budding Entrepreneurs (GLOBE) student-managed lending program assists business visionaries in the developing world. The University also sponsors business-development initiatives, including the annual James and Eileen Christmas Business Plan Competition and Pitch Event, and several events through the Venture & Innovation Center.

A combined 22 teams of students delivered their 10-minute presentations to an audience that included Maciek Nowak, Ph.D., Dean and Joseph H. and Maria C. Schwartz Distinguished Chair at Tobin; Aigberaodion Akhigbe, Ph.D., Associate Professor, Department of Economics and Finance; Mikael C. Bergbrant, Ph.D., Associate Professor, Department of Economics and Finance and Managing Investment Funds instructor; Zenu Sharma, Ph.D., Associate Professor of Finance, adviser to the blockchain fund, and Crypto Assets and Trading Strategies instructor; and Steven Keating, Chief Investment Officer.

As part of their research, the student teams used tools in Tobin’s state-of-the-art Financial Information Lab, including FactSet and the Bloomberg Terminal, which are widely used throughout the industry. Student teams evaluated the portfolio’s existing composition and performance to generate potential new investment ideas based on their analysis.

Students identified companies in the health-care, media and entertainment, pharmaceutical, technology, and veterinary sectors. Recommendations were equally divided between buy and sell opportunities, while one cryptocurrency team recommended a “hold” on the fund’s investment in Ethereum, the second-largest cryptocurrency after Bitcoin.

“We already have a large amount —28 percent—of the SMBF in Ethereum,” explained Jacob Najera, a senior majoring in finance. “It is valuable, but we felt that making more of an investment in it would cancel out investments in other coins that have the potential to grow more.”

Despite recent volatility in the cryptocurrency market, students remained enthusiastic about its possibilities. Bitcoin, the leading cryptocurrency, hit record highs in October, but quickly faced significant declines and high-volume liquidations, resulting in its worst monthly performance in three years in November.

Several students suggested that the current lower values make cryptocurrencies more appealing investment choices. “I think the fact that the market is down makes it an excellent buying opportunity,” explained John Norton, a senior finance major whose team pitched for an increased stake in Ripple, another leading cryptocurrency. “A correction off of October’s high was probably necessary, but it sets a foundation for long-term growth.”

Related News

St. John’s Cybersecurity Team Continues Run of Success

For the first time since 2019 and only the second time in its history, St. John’s University’s cybersecurity team has advanced to the regional finals of the Northeast Collegiate Cyber Defense...

Tobin College of Business Hosts Inaugural Private Equity Pitch Competition, Welcoming Top Business Schools to Manhattan

The Peter J. Tobin College of Business at St. John’s University recently convened undergraduate business students from across the country for its inaugural Private Equity Pitch Competition on February...

Vincentian and Grad Student Hopes to Use His Education to Elevate Those in His Native Country

Rev. Haile Suba Weldegiorgis, C.M., is not your typical business student. Nor is he your typical priest. But the 36-year-old native of Ethiopia is, in fact, both—an international student attending...