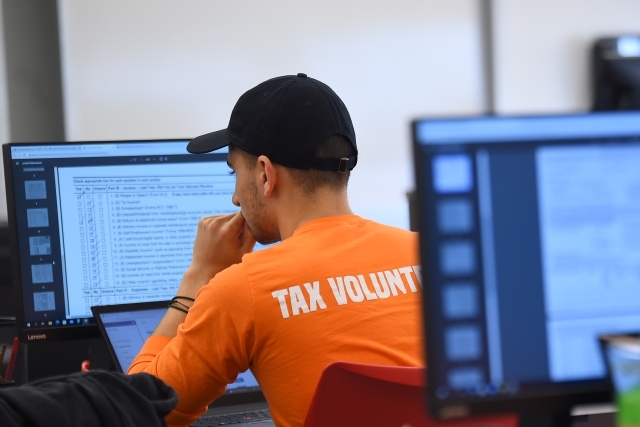

Students in The Peter J. Tobin College of Business are again participating in the Internal Revenue Service’s Volunteer Income Tax Assistance (VITA) program, which offers free tax preparation to low-income, disabled, and limited English-speaking taxpayers. Students help taxpayers file their returns; taxpayers then can use their tax refunds to purchase food and other necessities.

A longstanding service provided by the University, for the last 15 years St. John’s has partnered with the Food Bank for New York City to provide this unique and transformative service-learning experience.

Under the direction of Nina T. Dorata, C.P.A., Ph.D., Professor, Department of Accountancy, St. John’s volunteer filers have returned more than $20 million to needy taxpayers over nearly two decades. The University partnered with the Food Bank for New York City in 2009, expanding the program’s reach beyond the Queens, NY, campus.

“It creates a tangible impact in the lives of the people we serve,” said volunteer Tanisha Guirand, a second-year Tobin student from Brooklyn, NY, who is pursuing a Bachelor of Science degree in Business. “It’s a way of giving back that is very much in line with the spirit of this University.”

VITA programs have been in place for more than 50 years. In almost all circumstances, taxpayers must make $60,000 or less to qualify. Many VITA clients rely on the refundable Earned Income Tax Credit, a tax break for low- and moderate-income families, to fund living expenses.

The University’s 40-plus volunteers, mostly undergraduate Accounting students, had to pass an IRS certification test and undergo tax-preparation training. Students can process returns in person or virtually through the VITA Lab.

“For many of the people who file through VITA, this is the single largest check they receive this year,” said Andy Nieto, Associate Director of the Food Bank, who is in charge of its tax and financial services programs. “It can help boost them up out of poverty, for a little while at least. Plus, they don’t have to pay someone to pay their taxes.”

The Food Bank says its tax assistance program has saved filers more than $200 million in tax preparation fees and returned more than $1.2 billion to New Yorkers over the past 20 years. In 2021, IRS-certified volunteers associated with the Food Bank prepared more than 17,500 returns, producing more than $30 million in refunds for New Yorkers.

As many as 2,000 taxpayers are expected to reach out to St. John’s volunteers before the filing season ends on April 18.

The University’s VITA lab, where students connect online with clients, opened in 2014. St. John’s volunteers continued to file returns for VITA-eligible filers in the early years of the COVID-19 pandemic, meeting remotely with clients.

“It has really been a great partnership,” Dr. Dorata said. “Our students get experience and learn so much in a program that is consistent with the University’s mission and Vincentian heritage."

Related News

Former FTC Chair Engages with Students at St. John’s Henry George Lecture

The youngest-ever Chair of the Federal Trade Commission (FTC) brought her economic wisdom and public policy experience to St. John’s University on February 5, speaking to a gathering of students...

Insurance Leader of the Year Dinner Raises $3.6M for GSRM Students

A global gathering of aspiring students, insurance industry executives, and other supporters of the Greenberg School of Risk Management, Insurance and Actuarial Science (GSRM)—part of The Peter J...

Tobin Students Use Marketing Skills to Help Build a School in Guatemala

Students in The Peter J. Tobin College of Business at St. John’s University are putting their business education to work to expand access to schooling for children in rural Guatemala. During the Fall...