Under the slow, steady crawl of the lustrously lit stock exchange ticker that illuminates the Lesley and William Collins Business Analytics Lab, a select group of the best and brightest students from The Peter J. Tobin College of Business at St. John’s University make informed and impactful financial decisions in real time.

The small cadre of undergraduate and graduate business students—or in this case, money managers—are members of the highly competitive St. John’s University Student-Managed Investment Funds (SMIF) program. Collectively, they are responsible for more than eight million dollars in two funds, a portion of the University’s endowment.

“This is more than just theory,” remarked Conor Browne, a third-year Finance major from West Hempstead, NY. “The investment funds are real, as is the valuable experience of hands-on portfolio management.”

The Student-Managed Investment Funds have generated strong, long-term returns. Since its inception in 2001, the Undergraduate Student-Managed Investment Fund has annualized at 7.5 percent, a cumulative return of 332 percent. Since its inception in 2002, the Graduate Student-Managed Investment Fund has annualized at 9.7 percent, a cumulative return of 459 percent.

For the last 20 years, and under the tutelage of supportive faculty advisors, Tobin students have been the financial stewards of the SMIF and the protectors of a generous legacy of St. John’s alumni. The Undergraduate Fund was started in 2001 with a one million dollar donation from James P. Riley ’74CBA, ’75MBA, ’03HON, Retired Partner and Managing Director of Goldman Sachs Group, Inc. A year later, the Graduate Fund was created with a $250,000 donation from Thomas E. McInerney ’64UC, ’01HON, St. John’s University Board of Trustees Chair Emeritus and Chief Executive Officer and Cofounder of Bluff Point Associates.

Open to undergraduate and graduate students enrolled in specific finance courses, the experiential learning SMIF program is a unique opportunity for Tobin students to manage an actual investment portfolio by performing the duties of professional money managers. Students evaluate current holdings, analyze the business environment, and identify investments they believe will improve the long-term, risk-adjusted performance of the portfolio.

It is the students’ fiduciary responsibility to implement and maintain the funds’ long-term investment strategy and recommend specific investments that will benefit that strategy. Some of the research is performed individually, while other research is done as a team.

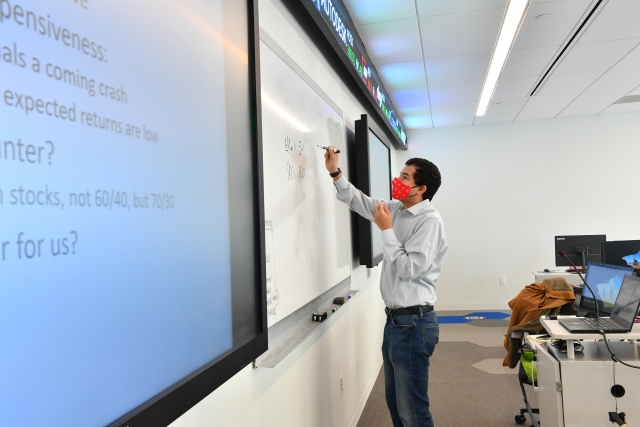

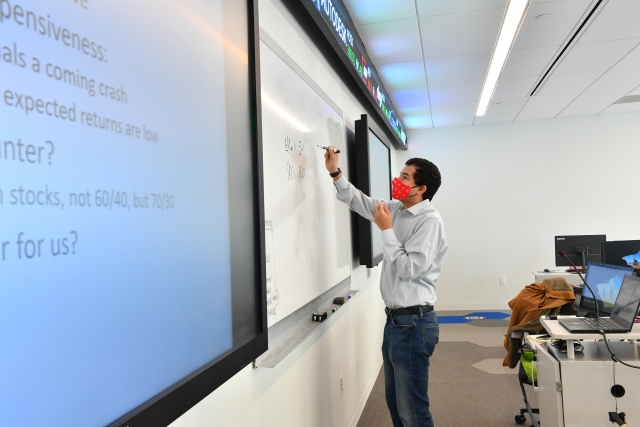

“This course enables me to bring to our students real-world applications to theories of economics and finance,” observed Andre B. de Souza, Ph.D., Assistant Professor, Department of Economics and Finance. “The engagement during this course is unlike any other, as every class discussion and action has a financial reaction, and the students come to better appreciate and understand this concept.”

Students make all investment decisions, with their recommendations being submitted to an Investment Committee for review. The Board of Trustees establishes the funds’ asset allocation and receives a yearly update on the progress of the funds from select SMIF students. Spending from the SMIF provides scholarships for qualified Tobin College of Business students. Since its inception, the Undergraduate Fund has awarded $1,823,481 to 244 student recipients and the Graduate Fund has awarded $712,480 to 91 student recipients.

During a recent class session, students presented assignments and their personal investment recommendations based on weekly research. After each presentation, classmates posed questions to their peer presenters and Dr. de Souza provided immediate feedback on the strengths and weaknesses of their financial analysis.

“This is a great, real-life, learning opportunity,” enthused Sarah Cullivan, a third-year student from Glendale, NY, who presented to the class her weekly review of obvious and nonobvious stock picks.

“We spend a semester learning how to evaluate stocks and better understand that you can’t make investments based on one piece of news or information.”

Life lessons of corporate social responsibility, conflicts of interest, and personal integrity are taught throughout the course. In the case of a conflict of interest, the student does not participate in research, discussion, and voting on any investment involved with the potential conflict of interest. Students learn that the funds’ interests come above all interests of the participants, as well as the value of consistent and uncompromising adherence to strong moral and ethical principles.

Another critical part of the curriculum focuses on the many ways in which the student money managers and the larger University can have a positive influence on society. Foremost among these is the wise allocation of the University’s financial investment resources and the moral obligation to adhere to the highest standards of social responsibility. Investments are encouraged in companies whose products, services, and actions are congruent with the Catholic and Vincentian values of the University. Students avoid companies whose products, services, or actions are deemed to be contrary to the University’s mission.

“At Tobin, we prepare our students to not just make a profit, but to make a difference,” said Norean R. Sharpe, Ph.D., Dean and Joseph H. and Maria C. Schwartz Distinguished Chair, The Peter J. Tobin College of Business.

“Our investments in experiential learning opportunities are providing valuable platforms for our SMIF students to learn important marketable skills."

Josh Miller, a third-year Finance major from Dallas, TX, took a long view of the direct and indirect benefits of the course. “This is an enriching example of experiential learning, and is the closest thing to having a real-life job.”

Josh—who has already secured an in-person summer internship in stock trading—credits the course for helping him land this position. “I have become so much more familiar with the markets. This class gives me valuable skills needed to conduct equity research and analysis, and present my ideas, no matter where or how my career unfolds.”

Related News

Q&A with School of Education Alumna Linda I. Rosa-Lugo, Ed.D. ’77ED, ’79M.S.Ed.

Linda I. Rosa-Lugo, Ed.D. ’77ED, ’79M.S.Ed., recently accepted a new role as President of the American Speech-Language-Hearing Association (ASHA). Prior to this, Dr. Rosa-Lugo has been an active...

TSOE Alumna Appointed Director of Curriculum in Amityville

Jessica Kemler ’99ED,’22Ed.D.—a double alumna of The School of Education at St. John’s University—began the new year as the new Director of Curriculum in the Amityville, NY, School District. “We are...

Alumna Celebrates Book Launch After Career Change

After developing a passion for helping the younger generation, Ashley Wilson ’14M.S.Ed. pivoted from a career in the music industry to work as an educator. She is also making her mark through her new...