Classroom research was put to real-world application on Wednesday, December 7, as students in The Peter J. Tobin College of Business at St. John’s University delivered their recommendations for a trio of University-supported investment funds.

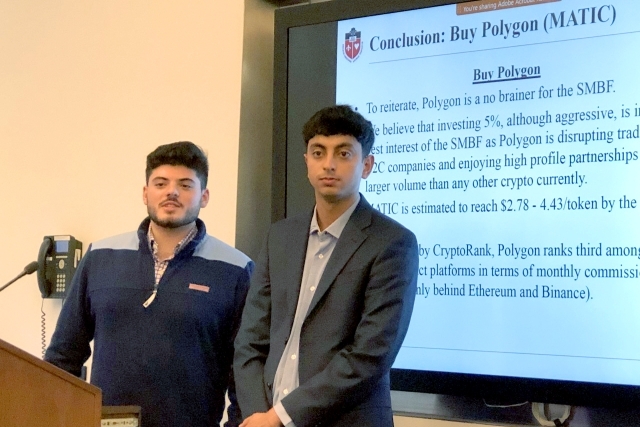

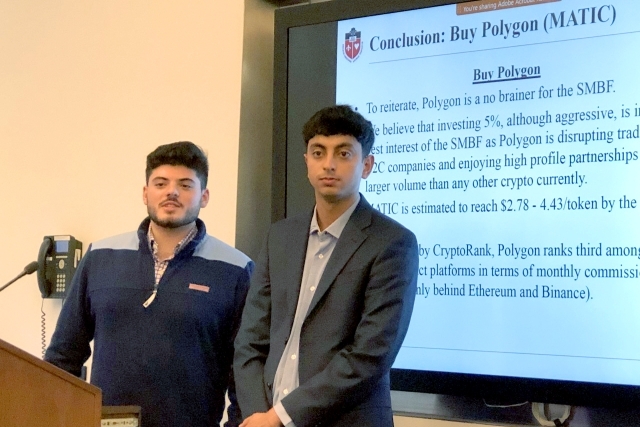

Six teams of students presented recommendations for cryptocurrency purchases as part of the University’s new Student-Managed Blockchain Fund. Six teams then pitched ideas for the equities-based undergraduate and graduate Student-Managed Investment Funds (SMIFs).

The end-of-semester presentations are the climax for students enrolled in the undergraduate courses Crypto Assets and Trading Strategies, and Managing Investment Funds that are part of the Bachelor of Science in Finance degree program, as well as the graduate course Quantitative Asset Management that is part of the Master of Science in Finance and Master of Business Administration programs.

The pitches took place at the University’s Manhattan, NY, campus before a gathering of students, faculty, administrators, and alumni.

Approved in May, the Student-Managed Blockchain Fund (SMBF) is a complement to the two-decades old Student-Managed Investment Funds in which students research stocks and present their investment recommendations to a committee of faculty, administrators, and business executives. If the committee approves the recommendations, the transactions are executed.

The undergraduate-managed SMIF is valued at $5.1 million while the graduate fund is valued at $3.3 million. Both funds, tied to long-term stock investments, have generated returns of 8% to 9% annualized since inception. The funds are part of the University’s endowment.

The new blockchain portfolio was funded with $100,000. Students research the top cryptocurrencies, which are focused on larger, more institutional coins (memecoins are prohibited). Their analysis is focused on blockchain technology and its real-world applications.

“It is nice to take a victory lap tonight and show off all that we learned,” said senior Brennen Bailey.

Cryptocurrency is a form of digital money that is based on blockchain technology. As a form of payment, it can circulate securely without monitoring from a central authority such as a government or bank. Cryptocurrencies also can be used as investment vehicles or exchanged for goods or services. As of January 2022, St. John’s accepts cryptocurrency for charitable donations.

Blockchain is a digital ledger that records transactions in code. A blockchain collects information together in groups known as “blocks” and holds the information together via cryptography.

It is a complicated technology that has seen wild fluctuations in value since emerging in 2009. Bitcoin, one of the leading cryptocurrencies, reached an all-time high of nearly $69,000 per coin in November 2021 but since has fallen to about $18,000.

In 2022, the cryptocurrency market has been weighed down by scandal, insolvency, rising interest rates, and investor panic.

Coping with these dramatic value changes is one of the lessons students learn in cryptocurrency investment, says Zenu Sharma, Ph.D., Assistant Professor of Finance, adviser to the fund, and Crypto Assets and Trading Strategies instructor.

“It’s an important development in the currency market and it’s good to have an academic interest in this new technology,” Dr. Sharma said. “The students have to make the decisions themselves.”

Brennen and teammate Tim Whidden, both seniors studying Finance, pitched the cryptocurrency Avalanche, which they believe is undervalued and versatile. Four other teams advocated purchases; one team—seniors Neha Iyer and James Lopez—advocated the hold of the cryptocurrency Solana, which declined following the collapse of crypto exchange FTX. “We still think there is potential there,” James said.

As in the SMIFs, students in the SMBF engage in research, generate investment ideas, analyze investment opportunities, and make recommendations to their classmates, faculty, administrators, and alumni. SMBF students vote on the recommendations of their classmates and approved trades are executed, subject to review by faculty and administrators. Two additional crypto teams will make presentations on December 15.

The state-of-the-art Business Analytics Lab has research tools such as FactSet and Bloomberg to guide students’ research.

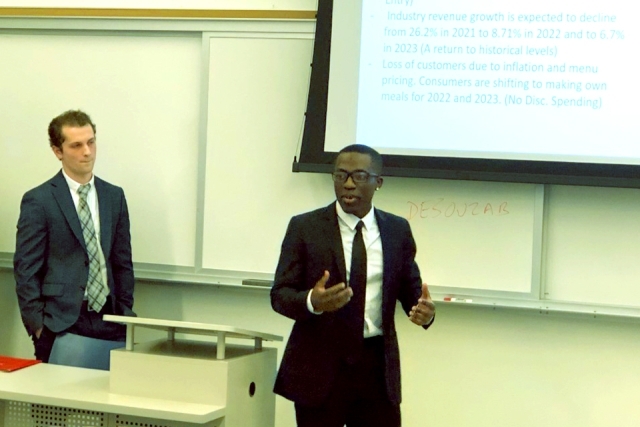

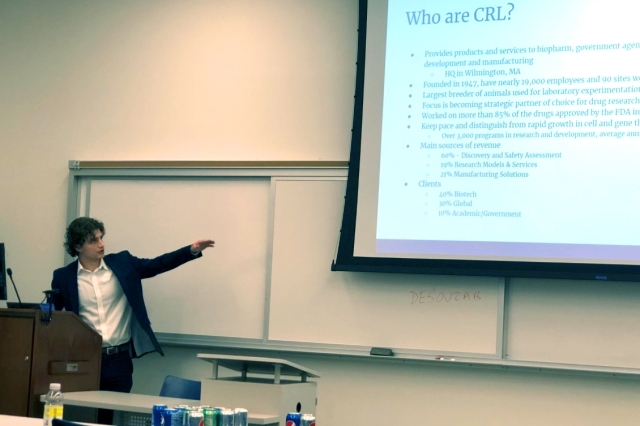

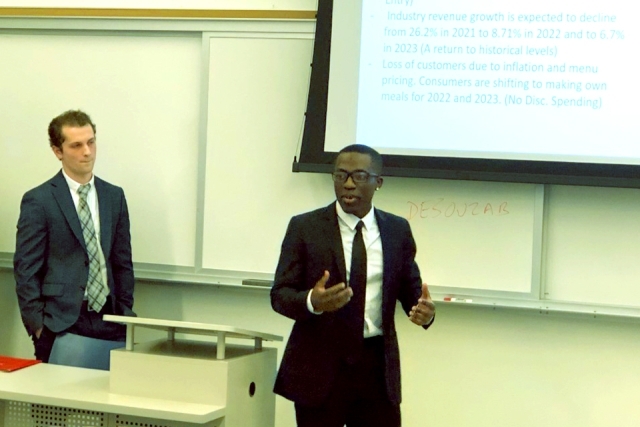

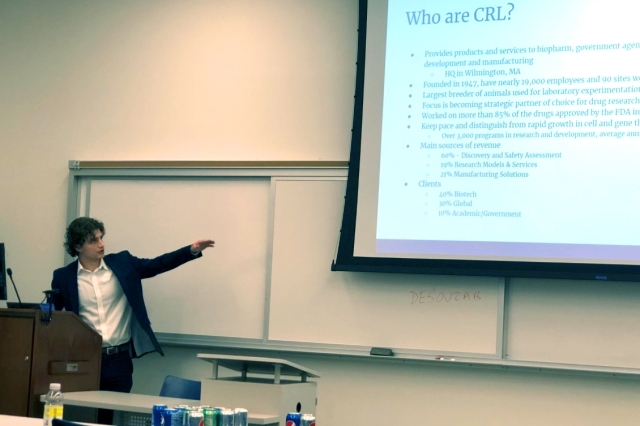

Students in the graduate SMIF pitched the purchase of ExxonMobil, and Texas Instruments was recommended for the undergraduate fund. Undergraduate students Angue Foretia, James Baquet, and Shane Walsh pushed for the sale of Darden Restaurants.

“We saw threats emerging to the company from inflationary pressures and enhanced competition,” Angue said. “We would prefer to sell Darden and invest the money in the presentations of our classmates.”