Technology is taking over the financial services industry, and The Peter J. Tobin College of Business is ahead of the curve in responding to student and employer demands.

Over the past two decades, technology has completely disrupted industries ranging from retail and music to car services and video rentals. Now, it is the financial services sector that is in the midst of a transformation.

Today, people can deposit checks via their cellphones and access capital through online peer-to-peer lending networks. They can manage retirement portfolios with a few clicks of a mouse and day-trade individual stocks on their smartphones for low flat fees. They can split a dinner check by sending money to their friends via an app, and they can pay for their morning coffee with Bitcoin.

This growth of financial technology (fintech) may just be the beginning. According to McKinsey & Co., global venture capital investment in fintech hit $30.8 billion in 2018, up from $16.8 billion in 2015 and just $1.8 billion in 2011.

“There are many processes in financial services that can be done better and cheaper with technology instead of with humans,” said Mikael Bergbrant, Ph.D., Associate Professor of Finance and Director of the Student-Managed Investment Fund (SMIF) at The Peter J. Tobin College of Business at St. John’s University.

“Everybody understands that there are enormous employment opportunities for fintech.”

The Growth of Fintech

The term fintech describes any application of technology to financial services. That covers a broad range of applications, but most are aimed at lowering costs, speeding up transactions, and increasing access to financial services for people and organizations.

“When you apply technology to this sector, what you are really doing is saying, ‘It is going to get easier and cheaper for people to access financial services,’” said Chris Concannon ’92MBA, President and Chief Operating Officer of MarketAxess Holdings Inc., which operates an electronic trading platform for fixed-income securities. “Technology really democratizes access to financial services and to information. Retail investors are accessing the market over the phone. They are being given investment advice over the internet; they are managing their finances with more sophisticated tools. That did not exist 10 years ago, and it was really fintech that helped deliver that.”

Alongside retail applications, fintech also helps institutional investors to simplify their processes and reduce costs. For example, MarketAxess, which Mr. Concannon called “a global Amazon-like market for fixed-income securities,” connects the global network of bond buyers and sellers and eliminates the need for firms to employ brokers in markets across the world.

“We are automating the largest market left on the planet that has not been automated,” Mr. Concannon said.

“Five years ago, there was a time zone problem if a European client was trading a European corporate bond with a US dealer. Today, that is mostly automated. The trade is all happening on someone’s computer. And they never even have to pick up the phone.”

Educating Students in Fintech

As technology becomes even more important to the finance sector, companies scramble to hire talent with a background—or at least training—in fintech. However, until recently, it has been rare for business schools to offer programs or courses centered on financial technology.

“Our business needs are not being met by most college programs,” said Mr. Concannon. “We get people that we need to retrain and spend money on. Think of things like agile technology development processes. That is not something that is being taught at the college level.”

In response to the demand from the industry, the Tobin College launched a trio of new classes specifically focused on fintech, with the first two running this Fall. The school also launched a fintech track for its Master of Finance program in the Fall of 2019.

Yun Zhu, Ph.D., Associate Professor of Economics and Finance at the Tobin College, is teaching two fintech courses this fall, covering topics such as machine learning and cryptocurrency. “To be honest, there is no textbook on fintech,” he said. “The industry is changing very fast.”

According to Dr. Zhu, faculty can remain current on fintech trends through cutting-edge research in the field.

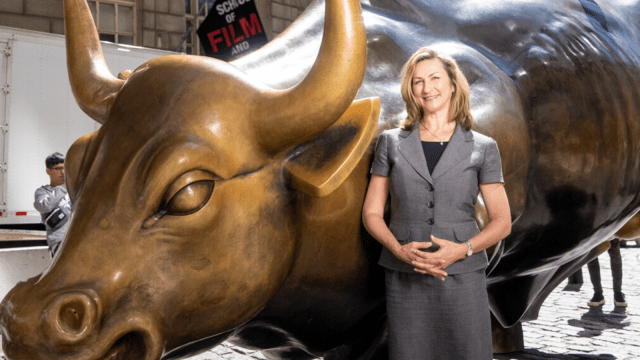

“The scholars at St. John’s add to our knowledge base,” said Anna D. Martin, Ph.D., Alois J. Theis Endowed Chair in Global Finance, Professor of Finance, and Executive Director of the Applied Finance Institute (AFI) at the Tobin College. “We lead the charge and develop new ways of thinking.”

The AFI, which encourages applied and experiential learning, also gives students access to fintech-related experiences and speakers. “We expose them to fields, including fintech, that are not part of their core studies,” said Jason Berkowitz, Ph.D., Associate Professor of Finance and current Director of AFI at the Tobin College. “Technology in general is just an exciting field, and fintech is one of the new fields that is important for our students to be exposed to.”

The Disruption Ahead

It is an open question just how much fintech will transform the financial services sector in the coming years. Digitization effectively put record shops and video rental stores out of business for good, and some observers believe the same could happen with traditional retail banks. However, the financial services sector has a number of differences from the industries that were essentially blown off their foundations by digital disruption.

For one, the largest consumers of financial services tend to be older than the most voracious buyers of music and movies, and this grayer population is sometimes slower to adopt new technologies than younger generations. But more importantly, large financial institutions have gotten in on the disruption game, buying or building out fintech solutions to keep pace with—and even incite—changes in the industry.

“When you think about what Uber has done to the taxis, the taxis were not investing in any technology,” Mr. Concannon said. “The large banks that provide financial services got smart. They invested in fintech many years ago because they saw that wave coming. The largest banks use technology to keep their position in the market. They had the foresight to say, ‘This is going to disrupt me, so I need to be the disruptor.’”

Dr. Berkowitz agreed. “The big banks definitely want to be part of the process,” he said. “They provide a service that is not going away. It is a question of, what direction are we moving?”

There is also uncertainty about whether robo-advisors could one day completely replace human financial planners. A robo-advisor offers financial advice or investment management online with minimal human interaction, providing services based on algorithms and clients’ stated preferences about risks and desired target returns. Such a model is less costly than hiring a financial planner (and, unless you have a unicorn of an advisor who can consistently beat the market, it should theoretically perform just as well, too). But money is tied up in emotions for many people, and many people may be willing to pay slightly more to sit across the kitchen table from an advisor who listens to their concerns. It remains to be seen whether the majority of investors will be comfortable trusting their financial futures to an algorithm.

“Many people still want human contact when it comes to their money,” Dr. Berkowitz said. “There is a little bit of that personal touch. Am I saying [robo-advising] is not going to happen? It certainly could become the wave. It is going to depend on future generations. I do not think my parents will ever go to robo, and I do not think that is the target market. The generation in college now are more receptive to talk to a computer about their finances.”

One outcome is likely: Whether they come from incumbent players or insurgent startups, fintech solutions that increase access and ease while cutting cost and complexity are likely to win out.

“It comes down to technology solving problems, making the market more efficient, and making it available to a wider audience,” Mr. Concannon said.